Remember What a 1% Decline Feels Like?

denke das nennt man denn auch überkauft, oder?......

i think we can call this a little bit overbought.........

wahnsinnschart von ticker sence! http://tickersense.typepad.com/ticker_sense/

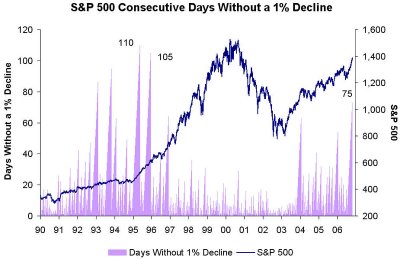

At the start of the month, we postet that the S&P 500 had gone 55 consecutive trading days without a 1% decline. At the time it was the third longest stretch of the current bull market (10/9/02-present).

Since that prior post, the S&P 500 has yet to record a 1% one-day decline, and the streak now sits at 75 trading days. The chart below shows that the current streak is now the longest of the bull market and also the longest since way back in 1995

i think we can call this a little bit overbought.........

wahnsinnschart von ticker sence! http://tickersense.typepad.com/ticker_sense/

At the start of the month, we postet that the S&P 500 had gone 55 consecutive trading days without a 1% decline. At the time it was the third longest stretch of the current bull market (10/9/02-present).

Since that prior post, the S&P 500 has yet to record a 1% one-day decline, and the streak now sits at 75 trading days. The chart below shows that the current streak is now the longest of the bull market and also the longest since way back in 1995

größer/bigger http://tickersense.typepad.com/photos/uncategorized/1declines1.jpg

bravo!

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

2 Comments:

This is the dullest market I can remember. I don't think it will change until after the election.

JOE is reporting tomorrow morning, will be interesting to hear what they have to say about the florida real estate market.

hi rob,

i agree.

i call it goldilocks recession......

Post a Comment

<< Home