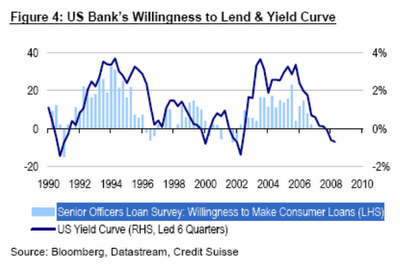

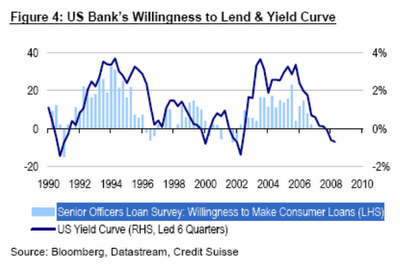

bank´s willingness to lend consumer loans

uh oh! this is a great chart that is one more indicator that something is in the making. but i have to admit that as long as all the crazy lbo financing for private equity http://immobilienblasen.blogspot.com/search?q=gaga, http://immobilienblasen.blogspot.com/2006/11/leverage-buy-outs-lbos-private-equity.html#linksetc isn´t slowing down the markets can hang in this time a bit longer. but when the willingness to lend to private equity and corporate america for their buybacks and takeovers (same for the rest of the world) is ebbing also we will have big problems. (i mean really big....). so watch for sign that deals fell through, increasing riskpremiums etc to judge the health of this main driver for all kinds of assets markets.

with this stat it´s only matter of time..../bei diesen daten nur ne frage der zeit........

U.S. corporate credit quality has been on a 25-year decline toward junk status, with almost half of all companies now rated below investment grade

As of September, junk, or speculative-rated issuers, defined as those rated "BB-plus" or below, stood at a record high of 49 percent, up from 48 percent at the end of 2005 and a low of 28 percent in 1992,

Downgrades and mergers have taken an even higher toll on U.S. nonfinancial, or industrial companies, with 61 percent carrying junk ratings. !!!!!!

http://immobilienblasen.blogspot.com/search?q=US+credit+quality+in+25-year+retreat+toward+junk-S%26P+

ups! finde dieser chart ist ein weitere indikator das hier wirklich ärger droht. ich muß aber zugeben das solange diese wahnsinnsübernahmen durch lbo´s für private equity http://immobilienblasen.blogspot.com/search?q=gaga, http://immobilienblasen.blogspot.com/2006/11/leverage-buy-outs-lbos-private-equity.html#links finanziert werden der markt durchaus noch ne zeit laufen kann. sollte aber diesem wichtigsten treiber der märkte und den schuldenfinanzierten übernahmen und aktienrückkäufen der saft ausgehen dürften mehr als nur große probleme kommen. also die nächste zeit ganz genau auf evtl. gecancelte deals und höhere risiskoaufschläge achten um einzuschätzen wie es um diesen sektor bestimmt ist.

dank geht an bill cara. rest and more details http://www.billcara.com/archives/2006/11/bankers_are_pulling_the_plug_t.html

Over the past 16 years in the U.S. there have been four periods of equity market shake-outs – 1990, 1994, 1998 and 2000 -- but 2000-2002 was the most severe. In the chart below, look at the light blue shaded indication of the banker’s willingness to lend – yes, the turndown periods were clearly 1990, 1994, 1998 and 2000 -- and 2006.

größer/bigger http://www.billcara.com/001t006.gif

with this stat it´s only matter of time..../bei diesen daten nur ne frage der zeit........

U.S. corporate credit quality has been on a 25-year decline toward junk status, with almost half of all companies now rated below investment grade

As of September, junk, or speculative-rated issuers, defined as those rated "BB-plus" or below, stood at a record high of 49 percent, up from 48 percent at the end of 2005 and a low of 28 percent in 1992,

Downgrades and mergers have taken an even higher toll on U.S. nonfinancial, or industrial companies, with 61 percent carrying junk ratings. !!!!!!

http://immobilienblasen.blogspot.com/search?q=US+credit+quality+in+25-year+retreat+toward+junk-S%26P+

ups! finde dieser chart ist ein weitere indikator das hier wirklich ärger droht. ich muß aber zugeben das solange diese wahnsinnsübernahmen durch lbo´s für private equity http://immobilienblasen.blogspot.com/search?q=gaga, http://immobilienblasen.blogspot.com/2006/11/leverage-buy-outs-lbos-private-equity.html#links finanziert werden der markt durchaus noch ne zeit laufen kann. sollte aber diesem wichtigsten treiber der märkte und den schuldenfinanzierten übernahmen und aktienrückkäufen der saft ausgehen dürften mehr als nur große probleme kommen. also die nächste zeit ganz genau auf evtl. gecancelte deals und höhere risiskoaufschläge achten um einzuschätzen wie es um diesen sektor bestimmt ist.

dank geht an bill cara. rest and more details http://www.billcara.com/archives/2006/11/bankers_are_pulling_the_plug_t.html

Over the past 16 years in the U.S. there have been four periods of equity market shake-outs – 1990, 1994, 1998 and 2000 -- but 2000-2002 was the most severe. In the chart below, look at the light blue shaded indication of the banker’s willingness to lend – yes, the turndown periods were clearly 1990, 1994, 1998 and 2000 -- and 2006.

größer/bigger http://www.billcara.com/001t006.gif

Labels: indicator, lbo, private equity, willingness to lend

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_euoz_2.gif)

0 Comments:

Post a Comment

<< Home